You are currently browsing the category archive for the ‘Politics’ category.

So for a while now we have all been hearing about this whole government bailout for financial institutions. Well, the dust has settled and the Obama administration has left its mark on history. While no disrespect is intended, Obama sure has provided some “change.”

For starters, he changed the record for most money involved in a bill passed by the United States. He will change the way some companies books look. He will change the value of our dollar by freely throwing another $800 billion into our economy. Sounds fun doesn’t it?

Recently a friend of mine put together a blog concerning the plans many politicians have with how to go about taking care of this financial crisis. I will tell you right now, the worst way to reduce debt is by creating more of it, and at an exponential rate might I add.

One of the speculations of what will be done with all this money is the re-purchase of some bad assets, bad debts, bad securities, and liabilities. This sounds great to the average person, however, such transactions can have very negative affects on a companies financial statements. What is more is that these money hungry institutions are the reason why our economy is in the toilet. That and our fun-loving consumers who think making $30,000 a year and spending $120,000 is a way of living.

My only concern with this idea of giving banks funds for bad assets as well as buying liabilities/securities that have gone bad is the balance sheet effects these transactions would have. What will most likely happen to most of these banks is a large extraordinary loss will be reported on their income statements due to the fact that their is no way in hell that the government will be willing to give them anywhere near the adjusted basis of most of those assets, which is what translates into a negative result for company’s balance sheets and income statements.

To explain what was said above, say ABC Bank has an asset on their books in which the adjusted basis (book value after depreciation) is $2 million. Then say the government looks at this asset and says, “$500,000”, well now what happens to this $1.5 million difference? See my point? Let’s not forget what effects this will have on the stock market, granted, their is no logic that can explain that psycho ward, but say we were actually using logic to explain the stock market, this loss would be a bad thing.

The plus to that is with the new stimulus bill, these institutions would be allowed to transfer NOLs to all the way back to 2005. NOL is the acronym for Net Operating Loss. This refers to any net loss from a business for a specific year of business. Usually, NOLs can be carried back two years and forwards 20 years, the beauty of this is you can use a loss from this year, to amend a prior year’s income, reduce it, and receive the tax benefit of a refund on the amount of your NOL. Granted, the amount of the benefit is dependent on the tax bracket in which the company in, however, something is something. Obama’s bill allows companies to take 2008 and 2009 losses back to 2005.

With most companies reporting in the red last year and this year, this may all turn out to be good on paper, however, all this does is further reduce government revenue and force us to rely more on debt as a means for financing our stimulus bills and really expensive inaugurations.

I almost forgot a nice piece of information. In case you didn’t know, the world economy revolves around ours. So you tell me, what do you make of the following statement:

The worst financial crisis in two generations has erased $14.5 trillion, or 33 percent, of the value of the world’s companies since Sept. 15; brought down Bear Stearns Cos. and Lehman Brothers Holdings Inc.; and led to the takeover of Merrill Lynch & Co. by Bank of America Corp.

Oh the joy…

This all to familiar image above is but a taste of things to come. With cash becoming more and more scarce and banks still dubious to release funds to anyone, it is no wonder more articles are springing up about companies going out of business.

This all to familiar image above is but a taste of things to come. With cash becoming more and more scarce and banks still dubious to release funds to anyone, it is no wonder more articles are springing up about companies going out of business.

Obviously Circuit City is the most well known company to declare chapter 7 bankruptcy, however, so many other businesses out there are headed in the same direction. When you see a company declare chapter 11 bankruptcy, expect 2 things: They will either downsize and cut costs and try to come up with a fresh source of financing to aid in the process of rebuilding, or after time passes and little changes, declare chapter 7 bankruptcy.

What I don’t understand is how despite the fact that the government threw $700 billion dollars at financial institutions, banks are still finding it difficult to loan money. I know that rules and regulations are more stringent than they were in the past, in the past all you needed was a first name and a pulse and you had a loan for anything, even if it was funding your lacadisic tendencies(Which seems to be the case for most), however, their needs to be some type of structure in place in order to make sure the right people are getting the money they need to continue doing business.

I don’t want to get into a discussion about the bailout, as it would lead to a post about how Bank of America is talking about nationalizing itself and how the government is rewarding failing firms for failing, instead of helping those who are doing well continue to do well in these hard times, but let’s be honest here, where is all this money going? And why do I hear more about CEOs using golden parachutes and splitting with millions, while the unemployment rate soars above 7.8% soon to be 10% by 2010.

The government isn’t doing anyone any favors. They aren’t “stimulating” the economy; in reality, they are stimulating themselves. I saw a clip of the John Stewart show a friend of mine sent me, and I have to say I agree with what he was saying. His idea was to do a reverse stimulus, which would work its way from the consumer and then lead to the bank. This makes sense, as most money spent by consumer to either pay bills or make purchases, ends up being deposited into the bank.

I honestly don’t see any of the bailout money being put to good use. Obama’s stimulus bill, while yes it does look promising, carries a high price tag in that not only does it cost close to $900 billion, more importantly, it allows for more government regulation, something I am opposed to and something that usually borders socialism, depending on the magnitude of the regulation.

There does, however, exist a positive side to all this. The fact that companies nationwide, specifically retail stores are doing poorly in sales means that consumers are beginning to understand the idea of living within their means, something we as Americans have lost sight of. Part of this whole problem is people paying debt with debt and digging themselves deeper and deeper into a hole with a shovel they never owned and a lot of land that was never theirs.

Don’t be dicouraged by the failing companies. Recession is not always a bad thing. For some it is an ideal buying opportunity. Let us not forget too that recessions are a natural part of the economy. The reason this recession is so painful is as a result of consumer spending with no concern for reality, major companies frivolously wasting money on bad investments and hopeless projects (Yes GM I am talking to you and your truck-line, being produced in a $2-3 a gallon of gas economy), companies amasing large amounts of liabilities, and banks throwing money at anyone with a first and last name.

It is almost like banks want government regulation. Then again, who wouldn’t want the government to spoon feed them everything, in return for loyalty. Good thing Bank of America isn’t nationalizi…..err….yeah it isn’t looking good….

Keeping up with this blog is harder than I thought. Something about wanting the posts to be well written and having little time to do everything makes it so much harder than I expected. I have plenty to talk about, but so little time with which to work with. Tomorrow at work I should have some free time to get to blogging, in the mean time, here is a video I found, this should keep you entertained until I find something worth posting on and which I can find the time to invest research into. On a side note, before you watch the video, consider this piece of advice: You will not always know what it is you are doing, however, it is imperative that in all situations, whether you know what you are doing or not, that you surround yourself with people that do know what they are doing. Something my dad always taught me. Dale Carnegie is the man, consider reading his books…

On to the video:

Well hello! After a few days of playing catch up with my studying and career hunt, I finally have a moment to blog and what better subject then that stimulus bill that is hovering over the minds of everyone in this country.

In my last post I was somewhat happy with the idea of the stimulus, and overall, I was pleased with the results it would bring. However, after further analysis and much deliberation within myself, I now come to realize it isn’t all it’s cracked up to be.

The bill went from some $815 billion to a nice 900 billion…what? With a deficit of somewhere around $11.9 trillion, you want to add the $700 billion and this $900 billion? What happened to cutting government spending? So then in order to cut government spending, we need to increase it and decrease government revenue (which is what this bill would do)? Huh?

What is worse is that the bill is causing a special blend of racism amongst parties. A friend of mine put together a well written blog concerning this subject, if you care to read it, feel free. What I mean by racism is that this bill is doing more splitting than it is uniting.

What happened to that bi-partisan speech Obama gave just a month or two ago? It seems to me their is a larger split in our house and senate than there was prior to his election. The stimulus bill itself caused such a political roar that every republican and a few conservative democrats voted against it. Regardless the bill passed the house due to the majority of democrats in the house, however, isn’t it accomplishing more harm than good?

I agree with most of the credits and tax law changes, but the bill goes beyond that. Included in it is a huge list of “things to do” that range from communication and transportation to education and miscellaneous jargon. What’s more is the bill is being sold as a way to create jobs, but given the number of jobs it would produce, the outcome would be a cost of 1.3 million for every job it created, doesn’t sound like the stimulation we all had in mind.

It seems as though we are beginning to hack through the jungle that was Obama’s rhetoric and coming to the realization that he may need a bit more behind his “change” if he expects to do anything about unity and problem solving. I am not putting the man down, he accomplished a lot through his election, however, the time for glorifying his every footstep because of the color of his skin or the use of the word change must pass, and I think we as Americans should begin focusing on the real issue at hand, not some media-fabricated issue of discrimination that will always exist regardless of the color of a person’s skin. (Because discrimination goes beyond skin in today’s world) Oh yeah and the horrible choice in his anti-tax administration isn’t helping make his judgment look like the right kind of judgment.

Where would you get the money to support such a bill if you are reducing our revenue and increasing our spending? You know the answer and so does China, a country that easily owns 40-50% of our countries loans outstanding. Makes you wonder who it is will be calling the shots in the world economy in the not so distant future. Won’t be US if we keep this up.

“Gov. Rod Blagojevich was thrown out of office Thursday without a single lawmaker coming to his defense, brought down by a government-for-sale scandal that stretched from Chicago to Capitol Hill and turned the foul-mouthed politician into a national punchline.” – Yahoo

I think the title says it all.

So I have to say, inspite of the fact that I never was happy Obama became president, as a tax professional, I like where his plans are going for tax credits and the like. Obviously their are two sides to the coin and what might be beneficial to you and I, may not be so beneficial to the reduction of our budget deficit of infinity trillions of dollars.

So everyone knows, I am majoring in accounting and plan on gettting a Masters in Taxation. I work for a Liberty Tax Service, but consider myself to know more than the average tax professional. To put it in other words, I spend my free time going on a tax forum at About.com and posting responses to people’s questions. I also tend to read IRS publications and receive emails whenever tax laws are updated, yeah I am crazy.

Of course Obama’s tax laws are of the utmost importance to me, and recently doing some research on his latest act, The American Recovery and Reinvestment Act (HR 598), I was actually pleased with what I saw.

I obviously don’t want to go into any major detail because I could sit here and go on and on, however, I wanted to highlight the major changes that I found important.

Among some of the changes included increases to credits like the Hope Tax Credit, the Earned Income Credit, the new Homeowners Credit, the Child Tax Credit, and a few other things as well. I found these important as far as credits were concerned especially since one of them directly affects me. Obama wants to change the Hope Tax Credit (which is one of the educational credits given), and allow students to include the cost of books as qualifying expenses for the purpose of calculating the credit, in addition, he also wants to increase the credit and make 40% of it refundable, which to me is huge as this credit is nonrefundable and generally only benefits a person if they have any tax liability after all deductions have been taken.

One of the major tax changes that I especially enjoyed was the Marking Work Pay Tax Credit. With this credit, a person receives a $500 credit for the first 6.2% of earned income and this credit would either reduce the amount of FICA taxes withheld throughout the year, or appear as a refundable credit on the person’s tax return. The wording may seem a bit deceiving, like most tax laws do, but it would greatly benefit most people, as its phaseout doesn’t start until your Adjusted Gross Income reaches $75,000.

Other things like the revised Net Operating Loss Carryback rules are a big help for businesses. The new law would allow businesses to carryback 2008 and 2009 losses 5 years, rather than the current 2 year limit. What this does is allows companies that had profit in the years of 2003-2008, to reduce their previous profit with losses they may have seen as a result of the current economic downturn, which would in turn yield a refund to them, and a hefty one for most as the corporate tax brackets start at 15%.

Granted these are just some of the credits, but you get the idea, most of the changes are just like he said, help the middle to lower classes. Of course this is the positive side to the argument, because remember that every credit we receive is money the government doesn’t see in revenue, which you may not care to much about, however, that doesn’t help our deficit. We’ll save that conversation for another day. Below is the article with the information, in case you get bored… Oh and if anyone ever has any tax questions, I offer a free consultation if needed.

The cost of this new tax act you ask? A mere 550 billion dollars….chump change if you ask GM, Ford and Chrysler….

In today’s world, nothing should surprise you. Expect almost anything from the general public and the Internet. You could go onto google right now, type monkey goats jumping through hoops on fire and you just might find it. Whatever the case, in today’s society nothing can be put past it. What’s more is even the craziest theory or idea is easily excepted by some. We may know some of these theories as Conspiracy Theories. You know those wack-jobs who can see the apocalypse spelled out in a bowl of cheerios. (If you really want to know just read the bible, might find answers there)

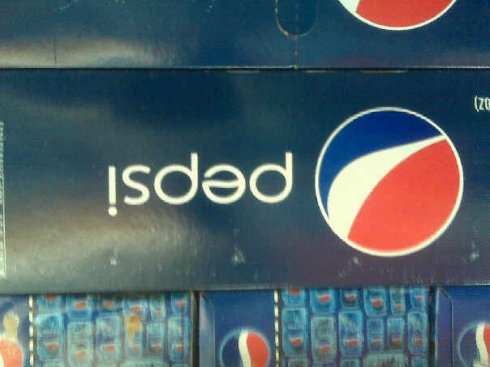

Recently a friend of mine had asked me if I had seen the new Obama endorsementPepsi label. I didn’t even know it had changed, I mean what could they possibly change? It is a red and blue color scheme with a wavy white streak through the middle of a circle. Looking at it now, it really hasn’t changed much, however, apparently the new Pepsi bottles and boxes all contain an omen for the future. Apparently Pepsi does more than just eat away at your intestinal wall and clean your car battery.

Either Pepsi just went republican, Nostradamus purchased a controlling interest in PepsiCo, or people are just being ridiculous. I may not be a fan of Obama, but this is stupid. For those that don’t see it, apparently Pepsi upside down says “is ded” and the new Pepsi symbol looks a lot like Obama’s “change” symbol.

Are people this gullible? From a realist’s stand point, I would say this is pretty stupid, I mean, who would sit there and figure this garbage out! Go outside! Read a book! Don’t waste my time with upside down Pepsi logos and origami $20 bills that allude to 9-11. And then they wonder why the rest of the world thinks we are retarded.

On a side not, if Pepsi wanted to catch the eye of the people it should start talking about changing its formula. I hear that when the word change is used, people believe anything you say, no matter how little experience… oh c’mon, you knew it was coming, I haven’t said a word about the election.

So everyone knows, I do not like the fact Obama is president, however, I hope I am wrong about what I think of him, for the sake of our country I hope I am wrong. He has my support, even though it hurts to say that….

P.S.

I know someone will try the flaming monkey goat search….it doesn’t exist, I looked, but it makes for a great hyperbole…

Recent Comments