You are currently browsing the tag archive for the ‘Bush’ tag.

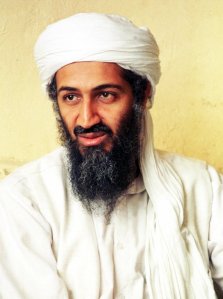

Anyone seen this guy? I here a nice reward is in store for his where abouts dead or alive. In a recent article posted by Yahoo!, the U.S. government believes that through the use of science and some advanced geographic satellite analysis, they can pin-point his location. Listed are three possible locations all within 12 miles of each other. That is fine and all, but isn’t this slightly counterproductive?

Correct me if I am wrong, but why would you publicize the location of a known and sought after terrorist on the Internet? Hopefully Bin Laden doesn’t read Yahoo!. Granted, I hope our intelligence is smarter than this and has some other plan up their sleeves, however, given their luck in the past with this sort of thing, I wouldn’t know what to say.

Hopefully, we are smarter than that and can hopefully catch this idiot some day. Although, we never could catch that secretary under the desk during the Clinton days, so this capture may never happen…

I almost forgot a nice piece of information. In case you didn’t know, the world economy revolves around ours. So you tell me, what do you make of the following statement:

The worst financial crisis in two generations has erased $14.5 trillion, or 33 percent, of the value of the world’s companies since Sept. 15; brought down Bear Stearns Cos. and Lehman Brothers Holdings Inc.; and led to the takeover of Merrill Lynch & Co. by Bank of America Corp.

Oh the joy…

This all to familiar image above is but a taste of things to come. With cash becoming more and more scarce and banks still dubious to release funds to anyone, it is no wonder more articles are springing up about companies going out of business.

This all to familiar image above is but a taste of things to come. With cash becoming more and more scarce and banks still dubious to release funds to anyone, it is no wonder more articles are springing up about companies going out of business.

Obviously Circuit City is the most well known company to declare chapter 7 bankruptcy, however, so many other businesses out there are headed in the same direction. When you see a company declare chapter 11 bankruptcy, expect 2 things: They will either downsize and cut costs and try to come up with a fresh source of financing to aid in the process of rebuilding, or after time passes and little changes, declare chapter 7 bankruptcy.

What I don’t understand is how despite the fact that the government threw $700 billion dollars at financial institutions, banks are still finding it difficult to loan money. I know that rules and regulations are more stringent than they were in the past, in the past all you needed was a first name and a pulse and you had a loan for anything, even if it was funding your lacadisic tendencies(Which seems to be the case for most), however, their needs to be some type of structure in place in order to make sure the right people are getting the money they need to continue doing business.

I don’t want to get into a discussion about the bailout, as it would lead to a post about how Bank of America is talking about nationalizing itself and how the government is rewarding failing firms for failing, instead of helping those who are doing well continue to do well in these hard times, but let’s be honest here, where is all this money going? And why do I hear more about CEOs using golden parachutes and splitting with millions, while the unemployment rate soars above 7.8% soon to be 10% by 2010.

The government isn’t doing anyone any favors. They aren’t “stimulating” the economy; in reality, they are stimulating themselves. I saw a clip of the John Stewart show a friend of mine sent me, and I have to say I agree with what he was saying. His idea was to do a reverse stimulus, which would work its way from the consumer and then lead to the bank. This makes sense, as most money spent by consumer to either pay bills or make purchases, ends up being deposited into the bank.

I honestly don’t see any of the bailout money being put to good use. Obama’s stimulus bill, while yes it does look promising, carries a high price tag in that not only does it cost close to $900 billion, more importantly, it allows for more government regulation, something I am opposed to and something that usually borders socialism, depending on the magnitude of the regulation.

There does, however, exist a positive side to all this. The fact that companies nationwide, specifically retail stores are doing poorly in sales means that consumers are beginning to understand the idea of living within their means, something we as Americans have lost sight of. Part of this whole problem is people paying debt with debt and digging themselves deeper and deeper into a hole with a shovel they never owned and a lot of land that was never theirs.

Don’t be dicouraged by the failing companies. Recession is not always a bad thing. For some it is an ideal buying opportunity. Let us not forget too that recessions are a natural part of the economy. The reason this recession is so painful is as a result of consumer spending with no concern for reality, major companies frivolously wasting money on bad investments and hopeless projects (Yes GM I am talking to you and your truck-line, being produced in a $2-3 a gallon of gas economy), companies amasing large amounts of liabilities, and banks throwing money at anyone with a first and last name.

It is almost like banks want government regulation. Then again, who wouldn’t want the government to spoon feed them everything, in return for loyalty. Good thing Bank of America isn’t nationalizi…..err….yeah it isn’t looking good….

Keeping up with this blog is harder than I thought. Something about wanting the posts to be well written and having little time to do everything makes it so much harder than I expected. I have plenty to talk about, but so little time with which to work with. Tomorrow at work I should have some free time to get to blogging, in the mean time, here is a video I found, this should keep you entertained until I find something worth posting on and which I can find the time to invest research into. On a side note, before you watch the video, consider this piece of advice: You will not always know what it is you are doing, however, it is imperative that in all situations, whether you know what you are doing or not, that you surround yourself with people that do know what they are doing. Something my dad always taught me. Dale Carnegie is the man, consider reading his books…

On to the video:

Recent Comments