You are currently browsing the category archive for the ‘Business’ category.

So most of us are familiar with creation, and how it is we as man came to be. God created Adam and Eve and then that crazy woman decided to listen to a talking snake and eat an apple from the tree, after which she did the woman thing and told Adam if he didn’t eat from it, no sex for weeks. Long story short, they got thrown out of the garden for being disobedient and now here we are years later, cursed with sin and inherently evil. I really hope that this isn’t the way Bill Gates feels, else his kids are in for years of pain.

According to a recent article on just about every website known to man, Bill Gates and his wife, do not allow their children to own anything Apple, specifically iPhones and iPods.

“There are very few things that are on the banned list in our household…But iPods and iPhones are two things we don’t get for our kids.”

Ok, I know that Steve Jobs is probably the single greatest competitor of Bill Gates, but doesn’t something like this beg the question of is bill scared? To start, he no longer is the CEO of the company, and while he may be a symbol of the company, his children choosing to own whatever they want shouldn’t do a damn thing to his rep. I mean Microsoft used Apple computers and Apple generated images to render those failures commercials of “I’m a PC and my computer sucks“, so what is the big deal with his kids owning the single greatest MP3 machine or cell phone?

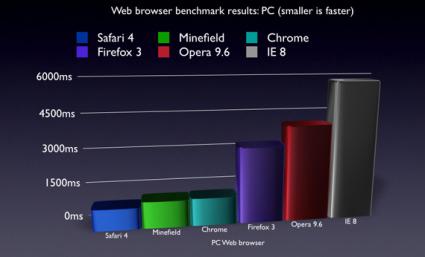

I think poor Gates is afraid. Maybe he is starting to come to terms with the fact that Macs work better than PCs and that the OS Macs use is a million time more stable than the garbage that took them five years to fail on. Maybe it was the below image, which shows Safari to be a far superior web browser than Microsoft’s beloved Internet Explorer. Wait…say what? These are the results based on use from a PC? Makes me laugh. Takes me back to when PC World wrote an article on the MacBook Pro and said that Vista ran the best on a MacBook Pro. I have to laugh.

Wait…say what? These are the results based on use from a PC? Makes me laugh. Takes me back to when PC World wrote an article on the MacBook Pro and said that Vista ran the best on a MacBook Pro. I have to laugh.

I can sit here for hours and post a 20 page paper on arguments, but I am not going too. I’ll just mention things like Steve Ballmer laughing at the iPhone when it first came out and saying it was a joke, only to be wrong just months later when the the iPhone took 40% of all smartphone sales in a 3 month period after its release. He was wrong even after that when the iPhone reached and passed its 10 million unit goal long before the end of 2008. Maybe the App Store, where over 300 million apps were downloaded in the first month, is evidence to how wrong he is. I even remember hearing him say the App Store was a joke and that no one would make money off of it. Tell that the developer of Trism, who made $250,000 in the first three months of his apps release.

Bottom line, PCs suck, Macs rule. If Gates wants to keep his kids from eating the Apple, then I hope he doesn’t throw them out of the house for choosing what they want. Granted, in the long run, I like what ended up happening with God, I get free will, and happily choose to serve Him, but I think Gates might be making a mistake…..doesn’t he know God runs Mac OSX?

So for a while now we have all been hearing about this whole government bailout for financial institutions. Well, the dust has settled and the Obama administration has left its mark on history. While no disrespect is intended, Obama sure has provided some “change.”

For starters, he changed the record for most money involved in a bill passed by the United States. He will change the way some companies books look. He will change the value of our dollar by freely throwing another $800 billion into our economy. Sounds fun doesn’t it?

Recently a friend of mine put together a blog concerning the plans many politicians have with how to go about taking care of this financial crisis. I will tell you right now, the worst way to reduce debt is by creating more of it, and at an exponential rate might I add.

One of the speculations of what will be done with all this money is the re-purchase of some bad assets, bad debts, bad securities, and liabilities. This sounds great to the average person, however, such transactions can have very negative affects on a companies financial statements. What is more is that these money hungry institutions are the reason why our economy is in the toilet. That and our fun-loving consumers who think making $30,000 a year and spending $120,000 is a way of living.

My only concern with this idea of giving banks funds for bad assets as well as buying liabilities/securities that have gone bad is the balance sheet effects these transactions would have. What will most likely happen to most of these banks is a large extraordinary loss will be reported on their income statements due to the fact that their is no way in hell that the government will be willing to give them anywhere near the adjusted basis of most of those assets, which is what translates into a negative result for company’s balance sheets and income statements.

To explain what was said above, say ABC Bank has an asset on their books in which the adjusted basis (book value after depreciation) is $2 million. Then say the government looks at this asset and says, “$500,000”, well now what happens to this $1.5 million difference? See my point? Let’s not forget what effects this will have on the stock market, granted, their is no logic that can explain that psycho ward, but say we were actually using logic to explain the stock market, this loss would be a bad thing.

The plus to that is with the new stimulus bill, these institutions would be allowed to transfer NOLs to all the way back to 2005. NOL is the acronym for Net Operating Loss. This refers to any net loss from a business for a specific year of business. Usually, NOLs can be carried back two years and forwards 20 years, the beauty of this is you can use a loss from this year, to amend a prior year’s income, reduce it, and receive the tax benefit of a refund on the amount of your NOL. Granted, the amount of the benefit is dependent on the tax bracket in which the company in, however, something is something. Obama’s bill allows companies to take 2008 and 2009 losses back to 2005.

With most companies reporting in the red last year and this year, this may all turn out to be good on paper, however, all this does is further reduce government revenue and force us to rely more on debt as a means for financing our stimulus bills and really expensive inaugurations.

I almost forgot a nice piece of information. In case you didn’t know, the world economy revolves around ours. So you tell me, what do you make of the following statement:

The worst financial crisis in two generations has erased $14.5 trillion, or 33 percent, of the value of the world’s companies since Sept. 15; brought down Bear Stearns Cos. and Lehman Brothers Holdings Inc.; and led to the takeover of Merrill Lynch & Co. by Bank of America Corp.

Oh the joy…

This all to familiar image above is but a taste of things to come. With cash becoming more and more scarce and banks still dubious to release funds to anyone, it is no wonder more articles are springing up about companies going out of business.

This all to familiar image above is but a taste of things to come. With cash becoming more and more scarce and banks still dubious to release funds to anyone, it is no wonder more articles are springing up about companies going out of business.

Obviously Circuit City is the most well known company to declare chapter 7 bankruptcy, however, so many other businesses out there are headed in the same direction. When you see a company declare chapter 11 bankruptcy, expect 2 things: They will either downsize and cut costs and try to come up with a fresh source of financing to aid in the process of rebuilding, or after time passes and little changes, declare chapter 7 bankruptcy.

What I don’t understand is how despite the fact that the government threw $700 billion dollars at financial institutions, banks are still finding it difficult to loan money. I know that rules and regulations are more stringent than they were in the past, in the past all you needed was a first name and a pulse and you had a loan for anything, even if it was funding your lacadisic tendencies(Which seems to be the case for most), however, their needs to be some type of structure in place in order to make sure the right people are getting the money they need to continue doing business.

I don’t want to get into a discussion about the bailout, as it would lead to a post about how Bank of America is talking about nationalizing itself and how the government is rewarding failing firms for failing, instead of helping those who are doing well continue to do well in these hard times, but let’s be honest here, where is all this money going? And why do I hear more about CEOs using golden parachutes and splitting with millions, while the unemployment rate soars above 7.8% soon to be 10% by 2010.

The government isn’t doing anyone any favors. They aren’t “stimulating” the economy; in reality, they are stimulating themselves. I saw a clip of the John Stewart show a friend of mine sent me, and I have to say I agree with what he was saying. His idea was to do a reverse stimulus, which would work its way from the consumer and then lead to the bank. This makes sense, as most money spent by consumer to either pay bills or make purchases, ends up being deposited into the bank.

I honestly don’t see any of the bailout money being put to good use. Obama’s stimulus bill, while yes it does look promising, carries a high price tag in that not only does it cost close to $900 billion, more importantly, it allows for more government regulation, something I am opposed to and something that usually borders socialism, depending on the magnitude of the regulation.

There does, however, exist a positive side to all this. The fact that companies nationwide, specifically retail stores are doing poorly in sales means that consumers are beginning to understand the idea of living within their means, something we as Americans have lost sight of. Part of this whole problem is people paying debt with debt and digging themselves deeper and deeper into a hole with a shovel they never owned and a lot of land that was never theirs.

Don’t be dicouraged by the failing companies. Recession is not always a bad thing. For some it is an ideal buying opportunity. Let us not forget too that recessions are a natural part of the economy. The reason this recession is so painful is as a result of consumer spending with no concern for reality, major companies frivolously wasting money on bad investments and hopeless projects (Yes GM I am talking to you and your truck-line, being produced in a $2-3 a gallon of gas economy), companies amasing large amounts of liabilities, and banks throwing money at anyone with a first and last name.

It is almost like banks want government regulation. Then again, who wouldn’t want the government to spoon feed them everything, in return for loyalty. Good thing Bank of America isn’t nationalizi…..err….yeah it isn’t looking good….

Recent Comments